When should I choose a 203k Standard loan over a Streamline loan?

2/16/2024

Choosing between an FHA 203k Standard and Streamline loan depends on your specific renovation needs and situation. Here's a breakdown of when each type shines:

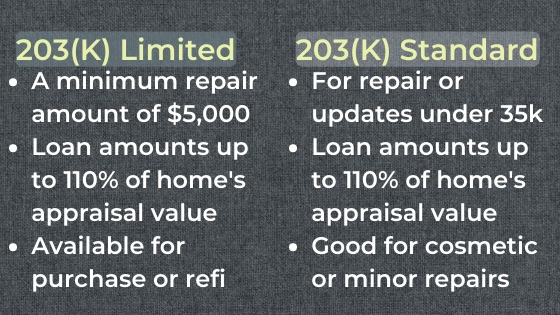

Choose a 203k Standard loan if:

- Your renovation project is extensive: This loan is ideal for major structural work, additions, complete kitchen or bathroom remodels, or significant upgrades to electrical, plumbing, or HVAC systems. If your plans exceed $35,000, the Standard loan is your only option.

- You need flexibility in your renovation scope: This loan allows for a wider range of renovations, accommodating unexpected changes or additions during the project.

- You have time for a more involved approval process: The Standard loan requires detailed plans, contractor bids, and potentially an FHA-approved consultant, so expect a longer processing time.

- You're comfortable managing complex logistics: With the ability to tackle major renovations, be prepared for the responsibility of coordinating contractors, inspections, and disbursements.

Choose a Streamline 203k loan if:

- Your renovation project is cosmetic or minor: This loan is perfect for smaller updates like painting, flooring, appliance replacements, or non-structural repairs under $35,000.

- You want a quicker and easier approval process: The Streamline loan requires less documentation and fewer formalities, allowing you to get started on your renovations faster.

- You have a limited budget: This loan restricts the renovation scope, potentially helping you stay within your financial constraints.

- You prefer a simpler approach: With more streamlined requirements, this loan minimizes paperwork and complexity, ideal for DIY enthusiasts or those with less renovation experience.

Beyond these guidelines, consider these additional factors:

- Timeline: If you have a tight deadline, the Streamline loan's faster approval process might be crucial.

- Experience: First-time homeowners with extensive renovations might find the Standard loan more suitable, while experienced renovators could navigate the Streamline process quickly.

Ultimately, the best choice depends on your unique needs and priorities. Consult a qualified mortgage professional familiar with both loan types to discuss your specific project and receive personalized guidance. Remember, the right loan helps you unlock your fixer-upper's potential while aligning with your budget, timeline, and comfort level. So, choose wisely, grab your toolbox or contractor's number, and turn your dream renovation into a beautiful reality!